Connect the dots with insights.

In-depth reporting across your portfolio

Investment Positions

Filter

Year

2025

Period ending

Q3

Convert to

USD

Commitment

Performance

USD 147.00M

Total commitment

Top 10 funds

by commitment

Vertex Ventures

Solar Stone Fund I

Peak Capital Venture Fund

EMT Fund VII

EMT Fund V

Strata Investments III

Eniac Ventures V

Cornerstone Fund I

Cornerstone Fund II

View

All investments

Entity

Security

Vintage

Period end

Commitment

Contributions

Remaining contributions

Horizon Equities

Vertex Venture Funds

2016

Sep 30, 2024

$200,000.00

$100,000.00

$100,000.00

Horizon Equities

Solarstone Fund I

2016

Sep 30, 2024

$200,000.00

$100,000.00

$100,000.00

Horizon Equities

Vertex Venture Funds

2016

Sep 30, 2024

$200,000.00

$100,000.00

$100,000.00

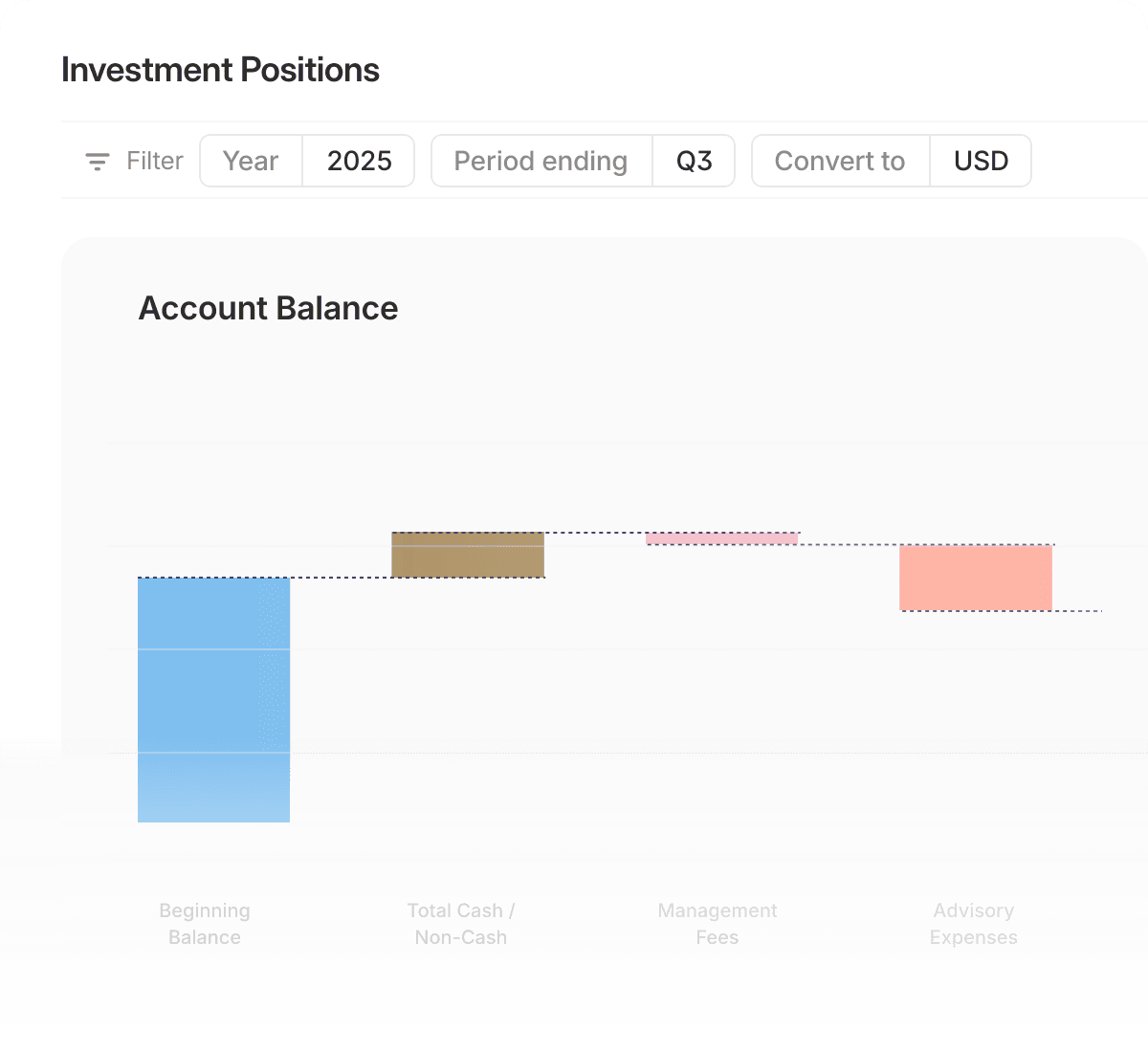

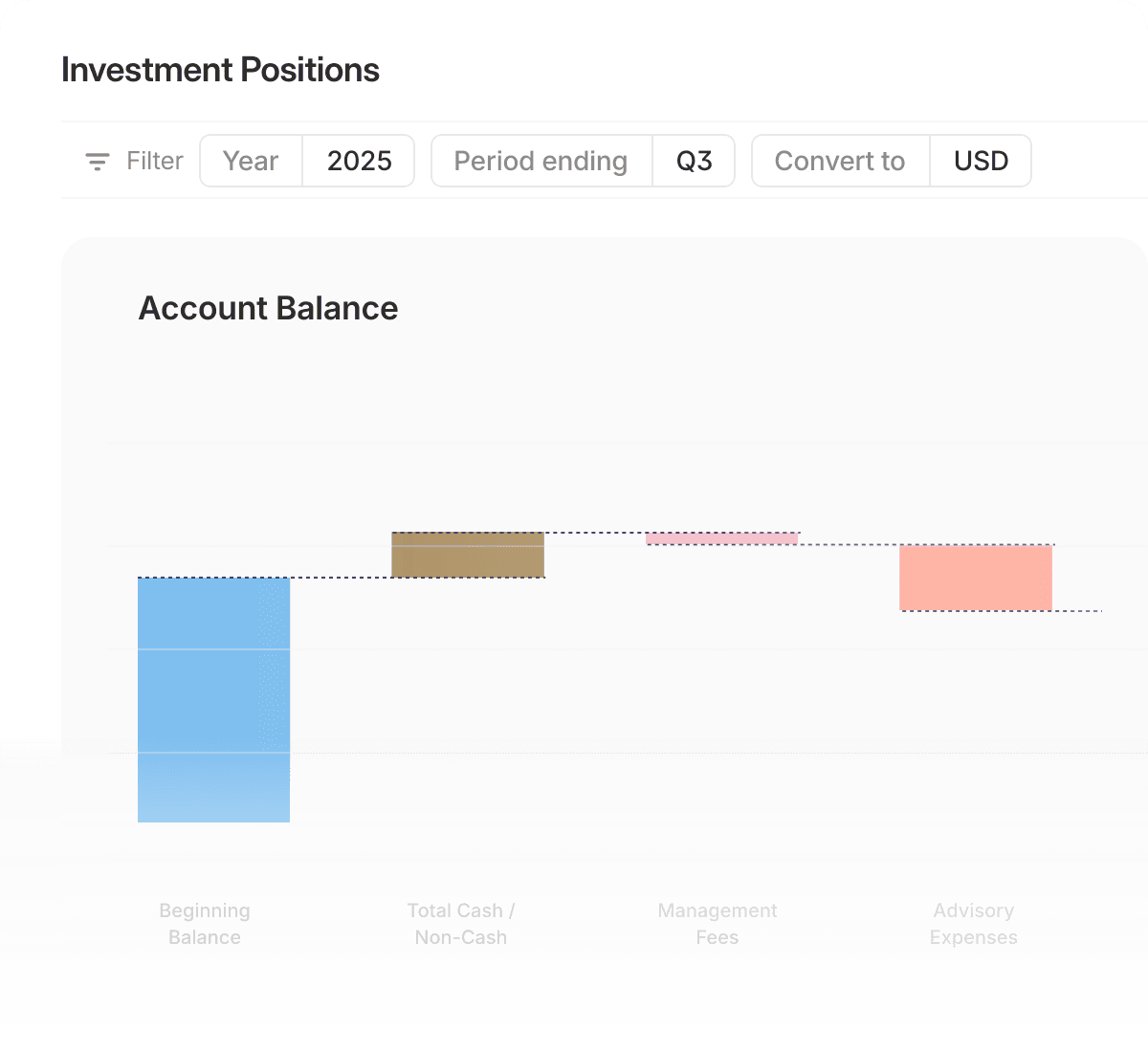

Investment Activity

Filter

Year

2025

Period ending

Q3

Convert to

USD

Account Balance

Beginning

Balance

Total Cash / Non-Cash

Management Fees

Advisory Expenses

View

All investments

Entity

Security

Period end

Beginning Balance

Contributions

Remaining contributions

Horizon Equities

Polaris Opportunity Fund I

Sep 30, 2024

$200,000.00

$100,000.00

$100,000.00

Horizon Equities

Polaris Opportunity Fund II

Sep 30, 2024

$200,000.00

$100,000.00

$100,000.00

Horizon Equities

Strata Investments III

Sep 30, 2024

$200,000.00

$100,000.00

$100,000.00

Private Equity - Funds

Vertex Venture Funds

Sep 30, 2024

$200,000.00

$100,000.00

$100,000.00

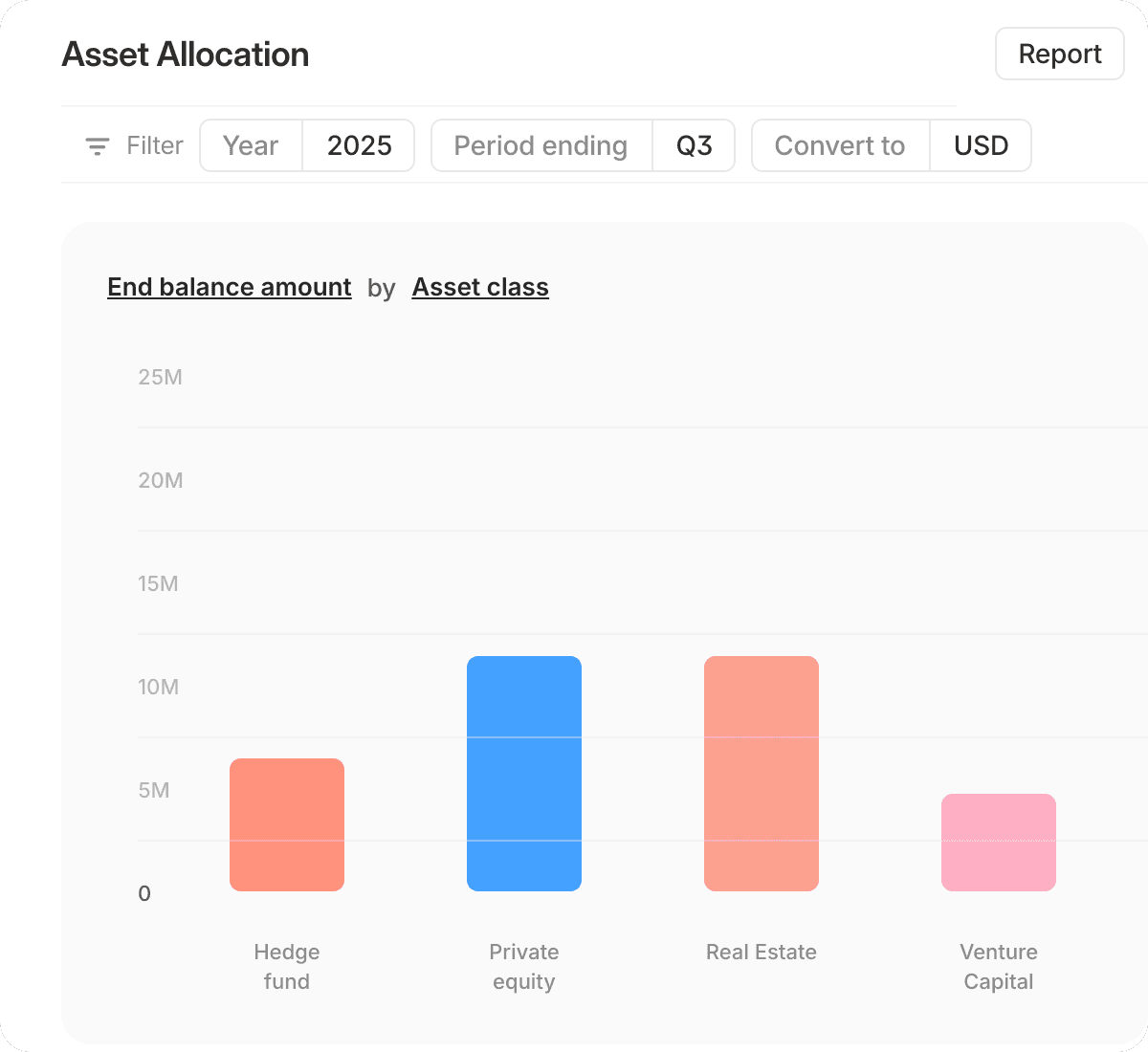

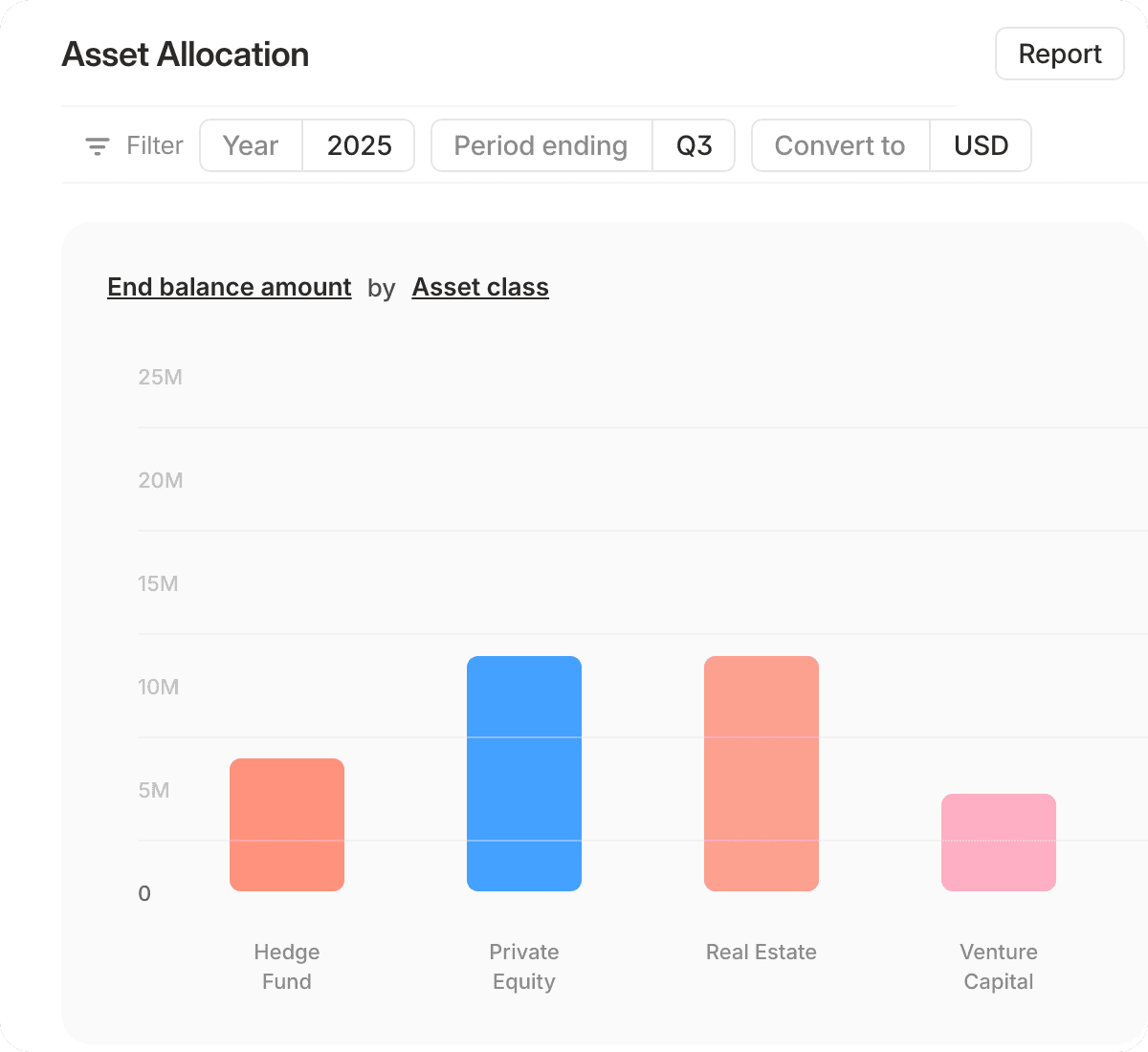

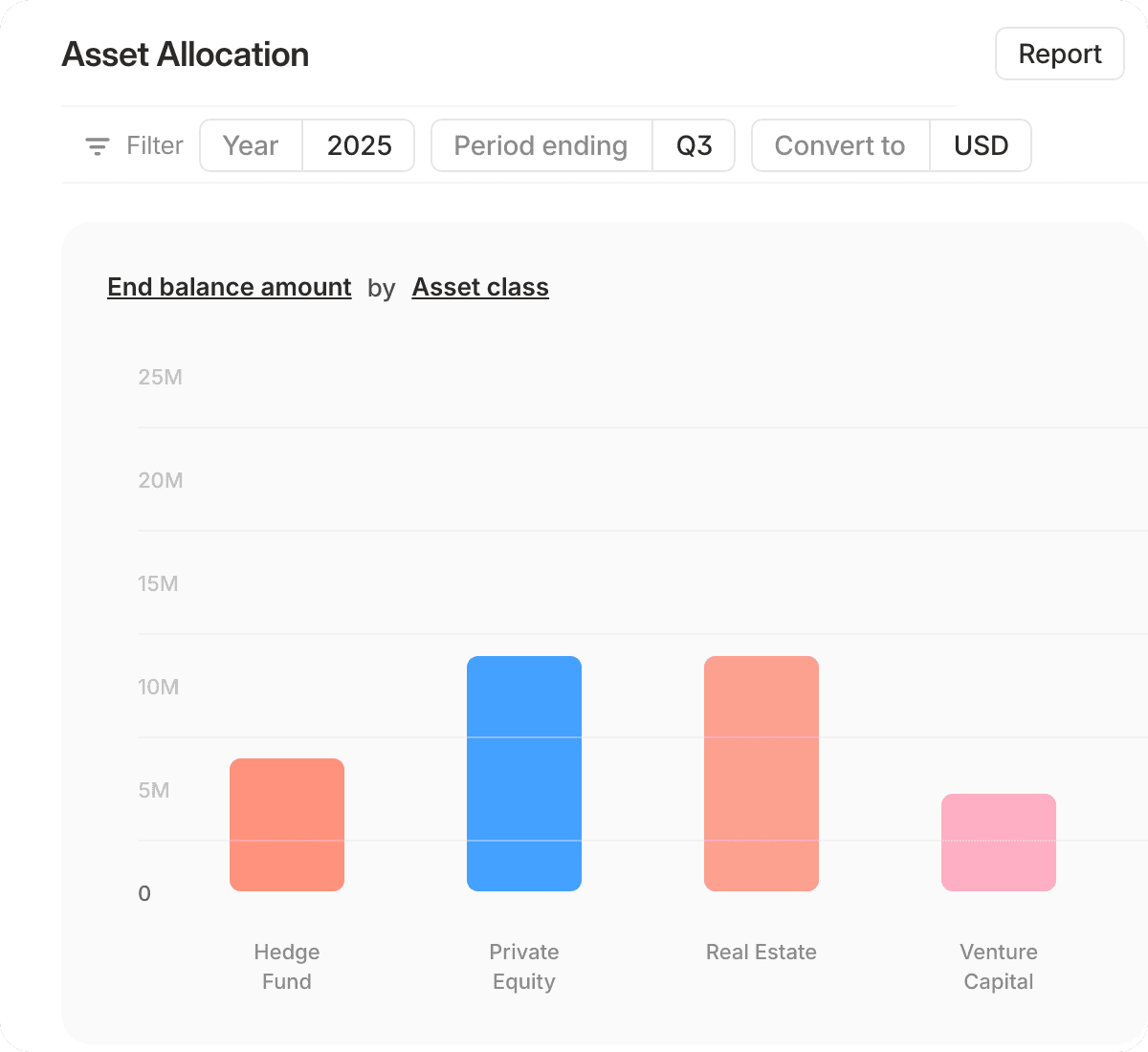

Asset Allocation

Report

Filter

Year

2025

Period ending

Q3

Convert to

USD

End balance amount

by

Asset class

Hedge Fund

Private Equity

Real Estate

Venture Capital

Natural Resources

25M

20M

20M

15M

10M

5M

0

View

All investments

Asset class / entity

Security

Period end

Ending balance

Hedge Fund

$2,500,000.00

Horizon Equities

Polaris Opportunity Fund I

Sep 30, 2025

$1,000,000.00

Horizon Equities

Strata Investments III

Sep 30, 2025

$1,000,000.00

Horizon Equities

Triton Opportunities IV

Sep 30, 2025

$500,000.00

Look Through

Filter

View

By Holding

Period end

Holding

Quantity

Cost

FMV

LP Ownership

LP Cost

LP FMV

Sep 30, 2025

Affinity Solutions, Inc.

85,000

$100,000.00

$100,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

At Work Building Co.

--

$4,050,000.00

$4,050,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Brixton Focal

159,000

$230,000.00

$230,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Connext Technologies

90,000

$300,000.00

$300,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Conduit Pulse, Inc.

1,400,000

$1,250,000.00

$1,250,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Frameworks Developments

--

$230,000.00

$118.000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Growth, Inc.

16,000

$100,000.00

$100,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Help Labs, Inc.

107,000

$100,000.00

$118.000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Intersect Labs, Inc.

75,000

$445,000.00

$445,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

J-Cube Labs, Inc.

3,000

$100,000.00

$118.000.00

0.03%

$30.00

$35.40

Sep 30, 2025

mEMR, Inc.

3,500,000

$10,000,000.00

$10,000,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Tradespec, Inc.

5,000,000

$2,000,000.00

$2,000,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Stride Fact Tech

110,000

$20,000.00

$20,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Undo AI, Inc.

22,675

$800,000.00

$118.000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Magnolis Inc.

187,000

$660,000.00

$660,000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Clearfeat Technologies

--

$120,000.00

$118.000.00

0.03%

$30.00

$35.40

Sep 30, 2025

AspiraAI

3,500,000

$99,030.00

$118.000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Forge Technologies

85,000

$100,000.00

$118.000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Affinity Solutions, Inc.

85,000

$100,000.00

$118.000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Affinity Solutions, Inc.

85,000

$100,000.00

$118.000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Affinity Solutions, Inc.

85,000

$100,000.00

$118.000.00

0.03%

$30.00

$35.40

Sep 30, 2025

Affinity Solutions, Inc.

85,000

$100,000.00

$118.000.00

0.03%

$30.00

$35.40

In-depth reporting across your portfolio

In-depth reporting across your portfolio

Instant insight

in real-time.

View portfolio insights with traceability to source documents. Mantle Portal links every figure back to its origin, enabling transparent, defensible reporting.

See what’s behind the numbers

Move beyond surface-level totals with transparent insight into the figures that drive them.

Value Progression

$25M

$20M

$15M

$10M

$5M

Total Value

$19,250,000.00

Residual value

$11,850,000.00

Distribution

$7,400,000.00

* Residual value is calculated from the ending balance in capital statements.

Traceable. Trustworthy. Transparent.

All your portfolio data links back to the original documents, giving you confidence in every figure.

Total Commitment

Total Contribution

Total Distribution

$150,000.00

$140,000.00

$16,500.00

$500,000.00

$230,000.00

$16,500.00

$40,000.00

$40,000.00

$34,000.00

$120,000.00

$115,000.00

$16,500.00

$25,000.00

$25,000.00

$34,000.00

$25,000.00

$25,000.00

$16,500.00

Total Contribution

Horizon Equities

$140,000.00

From Capital Statement

June 30, 2025

Efficiency is the new Alpha.

Real-time intelligence for the modern investment office.

Efficiency is the new Alpha.

Real-time intelligence for the modern investment office.

Efficiency is the new Alpha.

Real-time intelligence for the modern investment office.

Equity

Portal

AICPA

SOC2

SOC2

Google Cloud Partner

Equity

Portal

AICPA

SOC2

SOC2

Google Cloud Partner

Equity

Portal

AICPA

SOC2

SOC2

Google Cloud Partner